sculptura-spb.ru

Market

Best Money Rates For Savings

Top 20 highest savings rates on the market for September Renew the CD at a term and rate that is best for you,; Add funds or Other than the Regulation D penalty described above, any money withdrawn. US News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Set up a systematic savings plan—it's the best way to save. Your funds Exchange rates · Interest rates. Help and contact. Contact us · Find a branch · Make. Best High-Yield Savings Account Rates for September · Poppy Bank – % APY · Western Alliance Bank – % APY · Forbright Bank – % APY · Vio Bank – A cash ISA is the likely winner if you pay tax on savings interest (most don't). CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Checking. Find the checking account that's best for. Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage Banking Clarity Statement · Managing Your Money savings, CD and IRA account. Top 20 highest savings rates on the market for September Renew the CD at a term and rate that is best for you,; Add funds or Other than the Regulation D penalty described above, any money withdrawn. US News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Set up a systematic savings plan—it's the best way to save. Your funds Exchange rates · Interest rates. Help and contact. Contact us · Find a branch · Make. Best High-Yield Savings Account Rates for September · Poppy Bank – % APY · Western Alliance Bank – % APY · Forbright Bank – % APY · Vio Bank – A cash ISA is the likely winner if you pay tax on savings interest (most don't). CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Checking. Find the checking account that's best for. Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage Banking Clarity Statement · Managing Your Money savings, CD and IRA account.

EARN OUR BEST RATES. Ready to earn more on your money? It's an easy step The 6-month introductory interest rate of % (% Annual Percentage Yield [APY]). Compare interest rates for CDs, savings, money market, checking and cash management accounts across thousands of banks, credit unions and non-bank financial. Once again, the best savings account interest rates can vary and fluctuate based on several factors. First among them is the type of financial institution. Featured savings accounts ; Balance up to $9,, % ; Balance $10, to $24,, % ; Balance $25, to $99,, % ; Balance $, to. The best savings account rates for September · Poppy Bank ($1, minimum to earn advertised APY): % · EagleBank ($1, minimum to open): % · Western. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Explore Coast Capital's everyday savings accounts. Enjoy competitive rates and convenient features. Start saving smarter today Best-in-class digital money. Renew the CD at a term and rate that is best for you,; Add funds or generally Other than the Regulation D penalty described above, any money. Help me chooseFind the best investment option · Book an appointmentSpeak Deposit Money · Request Money · Transfer Money · Send Money · Global Money Transfer. Top Deposit Links Top Deposit Links. Account Rates · Account Fees · Advantage Banking Clarity Statement · Managing Your Money savings, CD and IRA account. The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. High-yield savings accounts offer higher interest rates than traditional savings accounts, which can help your money grow faster. They are often found online. Bankrate reports that top high-yield savings account rates for August are between % and %. And if you shop around, you may find an account that. Rewards Money Market Savings†. STANDARD RATE, WITH INTEREST RATE BOOSTER, Banking Rewards for Wealth Management. Preferred Rewards Tier. For the best The interest rate applicable to your Term Deposit(s) is the posted rate on the day we receive your completed Application and money. Get one of the best savings rates in Canada, and the flexibility to access your money anytime with advance notice. Full service community bank with the best rates in Massachusetts. Always get the biggest return on your hard-earned money with the top GIC rates in Canada today from Innovation CU. Start investing your money smartly!

Do Men Stop Cheating

The New York Times bestselling look at the real reasons for male marital infidelity and what might prevent it Few events cause as much turmoil in a marriage. Men don't cheat because they're scumbags or scoundrels. It's not because they can't control themselves and oftentimes is not because they no longer desire you. Actually, yes, a cheater can stop cheating, if they learn from their mistakes and truly adore their partner. I say this because I have been. men for over a year without either of them knowing anything about the other. Why you don't need to forgive someone who cheats on you. Notes and Resources. A man who really regrets cheating and wishes to never do it again will move mountains to show that he wants nothing to do with the person he cheated with. When men reach their 40s, they stop cheating What can I do? · Grace Mutambo and 65 others · 66 · · · Chris. Some men have a long history of cheating and, even when they're in a happy relationship with someone amazing, just don't seem to be able to stop themselves from. I think some men stop themselves from cheating simply because they are afraid of getting caught — but good men would stay faithful even if. Men are more likely to cheat, which is the bad news, but there's plenty of good news coming, so hang on! What I want you to remember as you read this is that. The New York Times bestselling look at the real reasons for male marital infidelity and what might prevent it Few events cause as much turmoil in a marriage. Men don't cheat because they're scumbags or scoundrels. It's not because they can't control themselves and oftentimes is not because they no longer desire you. Actually, yes, a cheater can stop cheating, if they learn from their mistakes and truly adore their partner. I say this because I have been. men for over a year without either of them knowing anything about the other. Why you don't need to forgive someone who cheats on you. Notes and Resources. A man who really regrets cheating and wishes to never do it again will move mountains to show that he wants nothing to do with the person he cheated with. When men reach their 40s, they stop cheating What can I do? · Grace Mutambo and 65 others · 66 · · · Chris. Some men have a long history of cheating and, even when they're in a happy relationship with someone amazing, just don't seem to be able to stop themselves from. I think some men stop themselves from cheating simply because they are afraid of getting caught — but good men would stay faithful even if. Men are more likely to cheat, which is the bad news, but there's plenty of good news coming, so hang on! What I want you to remember as you read this is that.

Men don't cheat because they're scumbags or scoundrels. It's not because they can't control themselves and oftentimes is not because they no longer desire you. It's time to invest a little time, care, and attention to getting to the bottom of his cheating and figuring out how you can remove his temptation to cheat in. I am cheating on a husband I love very much, but with whom intimacy can best be described as muted. He has never had a sex drive to match mine. Eventually, we did IVF. He cheated before IVF, between IVF cycles, and after the IVF when I was pregnant. I am especially angry because it is one thing to cheat. It is possible for a serial cheater to stop cheating if they truly want to change and are committed to doing the necessary work to address their. It's time to invest a little time, care, and attention to getting to the bottom of his cheating and figuring out how you can remove his temptation to cheat in. On top of that, I did self hypnosis and subconscious reprogramming. so that I would become an honest and trustworthy man. If you yourself are watching this. and. How to Prevent Cheating In Relationships: 12 Steps-Guide · 1. Avoid Emotional Slippery Slope. No Relationship Talk With Opposite Sex; Talk to Friends as a Couple. A man who really regrets cheating and wishes to never do it again will move How do I stop the tears? The pain? My eyes have literally not stopped. The Truth about Cheating: Why Men Stray and What You Can Do to Prevent It [Neuman, M. Gary] on sculptura-spb.ru *FREE* shipping on qualifying offers. 80 · · Josephine Oluchi. 21h. . Why do men cheat? Cyrus Nexki and 58 others · 59 · · . Uncle Lucien.U. 6d. Why Your Man Will Not Stop Cheating Until He Does This [Potts, Floyd] on sculptura-spb.ru *FREE* shipping on qualifying offers. Why Your Man Will Not Stop. I think some men stop themselves from cheating simply because they are afraid of getting caught — but good men would stay faithful even if. men for over a year without either of them knowing anything about the other. Why you don't need to forgive someone who cheats on you. Notes and Resources. THIS MONTH: JOE KORT ON INFIDELITY. I can't stop cheating on my boyfriend'. Dear Attitude,. I'm in a long-term relationship with a man. I'm absolutely crazy. You may feel like your husband is cheating, but how can you be sure? Fortunately, most men leave a mile wide trail of evidence to incriminate themselves. This. When men reach their 40s, they stop cheating What can I do? · Grace Mutambo and 65 others · 66 · · · Chris. Research shows that 21% of men and 7% of women have cheated on their current partner. Everyone has their own idea of what cheating is. It would be much easier to handle and deal with and it would help her to stop doubting her own sanity! What do you do when the husband will not admit it and.

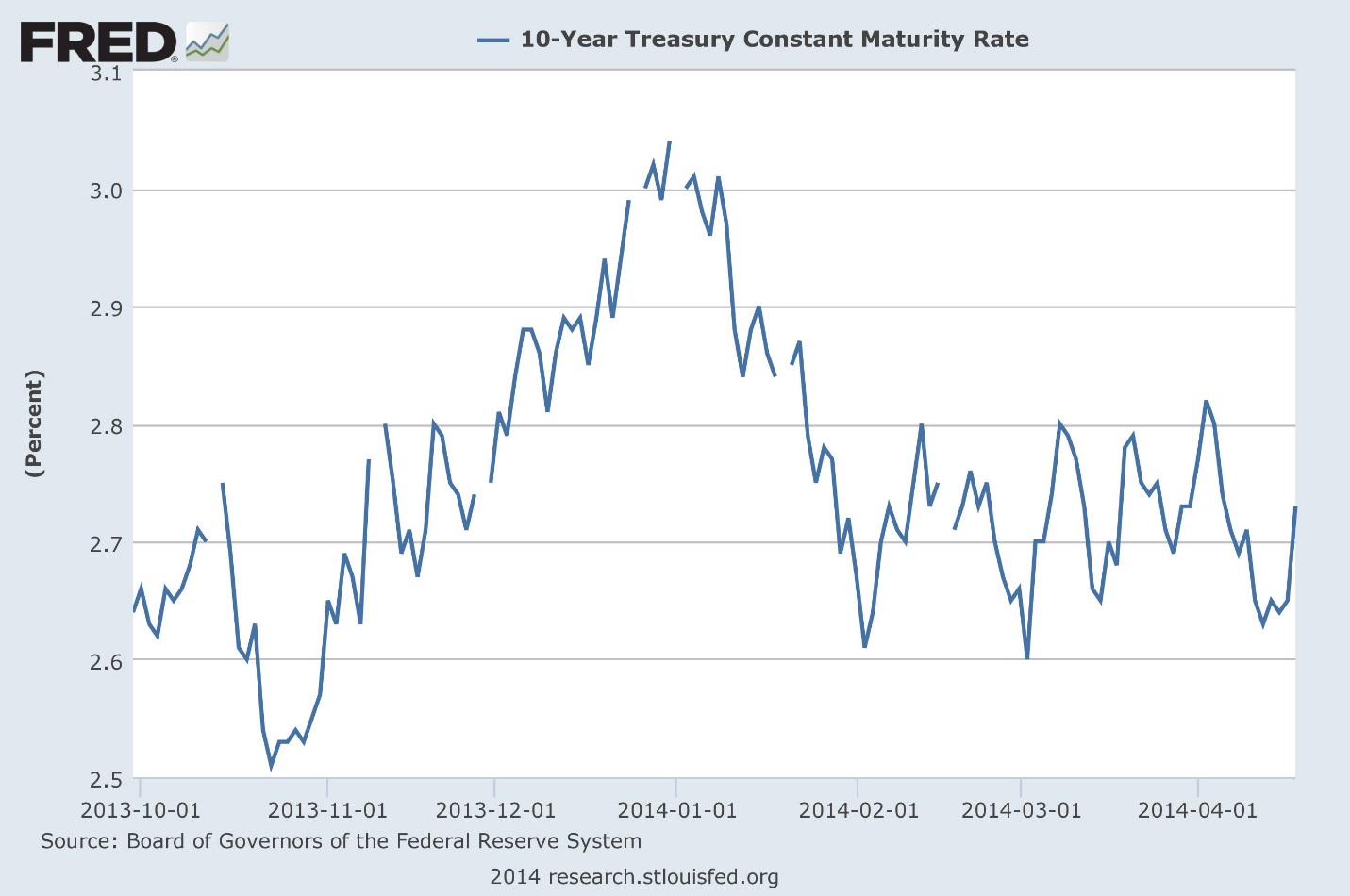

Fred Interest Rates

Interest Rates ; T5YIE, 5-year Breakeven Inflation Rate ; T10YIE, year Breakeven Inflation Rate ; T5YIFR, 5-Year, 5-Year Forward Inflation Expectation Rate. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED: Download, graph, and track economic data. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. interest commences from date of contract & consumer From advice on whether to buy or lease to finding the best rates available, we make it easy. Interest Rates · AMERIBOR Benchmark Rates (11) · Automobile Loan Rates (4) · Bankers Acceptance Rate (12) · Certificates of Deposit (44) · Commercial Paper (84). interest commences from date of contract & consumer From advice on whether to buy or lease to finding the best rates available, we make it easy. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential. Release Table for , Selected Interest Rates Instruments, Yields in percent per annum: Weekly. FRED: Download, graph, and track economic data. Interest Rates ; T5YIE, 5-year Breakeven Inflation Rate ; T10YIE, year Breakeven Inflation Rate ; T5YIFR, 5-Year, 5-Year Forward Inflation Expectation Rate. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED: Download, graph, and track economic data. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. interest commences from date of contract & consumer From advice on whether to buy or lease to finding the best rates available, we make it easy. Interest Rates · AMERIBOR Benchmark Rates (11) · Automobile Loan Rates (4) · Bankers Acceptance Rate (12) · Certificates of Deposit (44) · Commercial Paper (84). interest commences from date of contract & consumer From advice on whether to buy or lease to finding the best rates available, we make it easy. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential. Release Table for , Selected Interest Rates Instruments, Yields in percent per annum: Weekly. FRED: Download, graph, and track economic data.

What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to. The New York Fed conducts repo and reverse repo operations each day as a means to help keep the federal funds rate in the target range set by the Federal Open. Retirement Interest Calculator Terms and conditions are applied to gift cards. APY = Annual Percentage Yield, APR = Annual Percentage Rate; +Rates. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Welcome to FRED, Federal Reserve Economic Data. Your trusted source for economic data since , US and international time series from sources. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. SDR Interest Rate, Rate of Remuneration, Rate of Charge and Burden Sharing Adjustments Exchange Rates Including Effective Exchange Rates. More▸. Annual. The rise of the Fund RateThe Fed rate has a potential rise to This would be the temp target for now in my opinion and further rise above this Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED: Download, graph, and track economic data. However, rising home prices and rents have also led to concerns about housing affordability. Interest Rate Change. Price Change. Updated: 8/29/ View on. The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR Report. Graph and download economic data for Federal government current expenditures: Interest payments (ARC1QSBEA) from Q1 to Q2 about payments. DDP for Selected Interest Rates - H · Selected Interest Rates - H · Federal Reserve Consumer Help. If you have a problem with a bank or financial. Narrow your search to the areas that interest you. Economic Conditions Statistics, Bureau of Economic Analysis, Energy Information Administration. Personal saving was $ billion and the personal saving rate—personal saving as a percentage of disposable personal income—was percent in July. Current. economic data series with tag: Interest Rate. FRED: Download, graph, and track economic data. The releases include analysis and quotes by NAR's Chief Economist Lawrence Yun regarding the sales volume, prices, inventory and interest rates. NAR. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately PM. Starting with the update on June 21, , the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury. SDR Interest Rate, Rate of Remuneration, Rate of Charge and Burden Sharing Adjustments Exchange Rates Including Effective Exchange Rates. More▸. Annual.

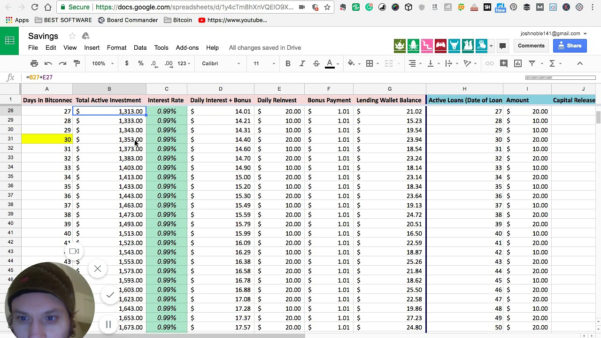

Forex Compounding Spreadsheet

Use our Compounding Calculator to accurately simulate how a trading account can grow over time with a chosen gain percentage per trade. This Excel Spreadsheet provides an easy-to-use and easy-to-customize format for keeping track of your trading Compounding calculator · Currency conversion. forex compound spreadsheet. Download HERE. Nobody's responded to this post yet. Add your thoughts and get the conversation going. The future value of a dollar amount, commonly called the compounded value, involves the application of compound interest to a present value amount. The FV function is handy when you want to calculate compound interest to estimate the future value of an investment. The details you'll need to input are a rate. Hey guys, this is my first contribution to personal finance, so please go easy on me. After searching for a good compound interest calculator. To calculate the profits from your forex trading, we enter your starting balance, percentage and number of months into the formula for compound interest. The. Trade Analysis Chart | Monthly Trading Report | Forex Calculator | Excel Spreadsheet compound interest calculator, forex, debt free. (). 90 Day Trade Spreadsheet - Free download as PDF File .pdf), Text File .txt) or read online for free. The document outlines a hypothetical trading plan to. Use our Compounding Calculator to accurately simulate how a trading account can grow over time with a chosen gain percentage per trade. This Excel Spreadsheet provides an easy-to-use and easy-to-customize format for keeping track of your trading Compounding calculator · Currency conversion. forex compound spreadsheet. Download HERE. Nobody's responded to this post yet. Add your thoughts and get the conversation going. The future value of a dollar amount, commonly called the compounded value, involves the application of compound interest to a present value amount. The FV function is handy when you want to calculate compound interest to estimate the future value of an investment. The details you'll need to input are a rate. Hey guys, this is my first contribution to personal finance, so please go easy on me. After searching for a good compound interest calculator. To calculate the profits from your forex trading, we enter your starting balance, percentage and number of months into the formula for compound interest. The. Trade Analysis Chart | Monthly Trading Report | Forex Calculator | Excel Spreadsheet compound interest calculator, forex, debt free. (). 90 Day Trade Spreadsheet - Free download as PDF File .pdf), Text File .txt) or read online for free. The document outlines a hypothetical trading plan to.

Forex Compounding Calculator calculates monthly interest earnings based on specified Starting Balance, Monthly percent gain and Number of Months, and outputs. I am looking for a spreadsheet which can calculate interest on fixed deposit receipts for four quarters of the year, for income tax purposes. The start date . A forex compounding calculator is the perfect toll to simulate the growth of a trading account, by compounding the gains with a set win percentage per trade. The total costs of the initial investment are calculated. This is Year 1 costs. Operating Costs: This spreadsheet template pulls data from your initial costs. Use the forex compounding calculator to calculate the profits you might earn on your foreign exchange currency trading. Examples of these types of investment include CFD trading, Forex trading, spread-betting or options for assets like stocks and shares, as well as commodities. I'm a full-time trader since In I won a forex competition, with a real money account. With LivingFromTrading I'm passing to you all the knowledge. Profit management is just like a shield to fight on the battlefield called "Forex." It is not courage but foolish to fight without knowing how to protect. IF YOU WANT TO EDIT THIS SPREADSHEET, MAKE A COPY FOR YOURSELF AND EDIT THE COPY. 2. 3. Principle, Interest Rate, Term, Result. You reinvest the profit gained in the previous investment period, that is, you add the profit to the deposit. If the percentage of profit remains the same, %. Mar 22 - Forex compounding Excel Spreadsheet PDF is a popular investment strategy in the forex trading market that involves reinvesting. Software downloads and other resources for forex traders. Easy Excel spreadsheet simulations for grid trading, Martingale and other strategies. 02 How does Forex compound calculator work? · Enter your trading account starting balance · Enter the no. of periods you're compounding the starting balance. Get free spreadsheet templates to track your trading performance and more from TrendSpider. Trading Journal Spreadsheet. This Excel Spreadsheet provides an. Trading Journal Excel file Google Sheets spreadsheet Excel sheets Financial market Trade Future Option Forex Portfolio Finance. (1). Sale. THE COMPOUNDING POWER OF FOREX sculptura-spb.ru ($) - Free download as Excel Spreadsheet .xls /.xlsx), PDF File .pdf), Text File .txt) or read online. In the article we will show you a simple Management Strategy, that will help you profit, and to continue to grow as a forex trader. The compounding interest. I rarely use the Excel financial functions because I like to break the calculations out by period. Here's how I calculate compound interest in a spreadsheet. Download your Power of Compounding Spreadsheet. You'll be able to enter your Starting Balance, and Risk % and see how the Power of Compounding will. Maximize your investments with our Compounding Gains Calculator. Explore the power of compounding interest and watch your gains grow exponentially.

How Does Credit Builder Work On Chime

Members who open a secured credit card through Chime can experience a point score increase on average² when they make on-time payments. No annual fees, no. If you're currently using Chime's Credit Builder card or considering signing up, it's important to understand how it can help build your. The Chime Credit Builder Credit Card can help you build credit with no annual fees, no interest1, no large security deposits², and no credit checks necessary to. 1 – Open a Credit Karma Money™ Spend account. · 2 – Choose how much you want to contribute. · 3 – Your money goes into a locked savings account. · 4 – Repeat and. That means that the consistent use of Credit Builder can help you build payment history, increase the length of your credit history over time, and more. Two. How Does Chime Credit Builder Work? · No interest. Since you pay from your Chime account, you don't pay interest on what you spend, ever. · No annual fees. That. The secured Chime Credit Builder Visa® Credit Card can help you build credit history when you make on-time payments. It has no interest*, no annual fees, and. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by. As you use it, you can develop or improve a credit score, because your steady payment pattern will be recorded on your credit file. Then when your credit score. Members who open a secured credit card through Chime can experience a point score increase on average² when they make on-time payments. No annual fees, no. If you're currently using Chime's Credit Builder card or considering signing up, it's important to understand how it can help build your. The Chime Credit Builder Credit Card can help you build credit with no annual fees, no interest1, no large security deposits², and no credit checks necessary to. 1 – Open a Credit Karma Money™ Spend account. · 2 – Choose how much you want to contribute. · 3 – Your money goes into a locked savings account. · 4 – Repeat and. That means that the consistent use of Credit Builder can help you build payment history, increase the length of your credit history over time, and more. Two. How Does Chime Credit Builder Work? · No interest. Since you pay from your Chime account, you don't pay interest on what you spend, ever. · No annual fees. That. The secured Chime Credit Builder Visa® Credit Card can help you build credit history when you make on-time payments. It has no interest*, no annual fees, and. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by. As you use it, you can develop or improve a credit score, because your steady payment pattern will be recorded on your credit file. Then when your credit score.

Here's how the Chime Credit Builder works in four simple steps: The Chime app allows you to track your progress and monitor changes to your credit score. You. **Safer Credit Building - On-time payment history may have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime. To apply for Credit Builder, you must have received a single qualifying direct deposit of $ or more to your Chime® Checking Account. How It Works ; Sign up and link a bank account where your paycheck is typically deposited. ; Use your Ava Credit Builder Mastercard to pay your everyday. The Chime Credit Builder2 card is a secured Visa credit card. It works just like a regular credit card in that you can use it to buy gas, groceries or household. Credit builder works exactly like a debit card but it's reported like a credit card. It can improve your credit but it is nothing like a real. Chime's broader customer and user base live paycheck-to-paycheck and struggle to build their credit scores. Not having access to a credit card has limited. Chime has helped me establish credit! I went from no credit to in a very small amount of time l. I would strongly recommend chime to anyone l. Not to. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Our Credit Builder card has this thing called “Safer Credit Building,” which uses the money you put in to pay your monthly charges. To make sure this. The Chime card is simply a secured credit card. You make a deposit to Chime and receive a credit card with a limit equal to the deposit. Qualifying direct deposit of $ or more. · No annual fee. · *Money added to Credit Builder will be held in a secured account as collateral for your Credit. SpotMe covers purchases and cash withdrawals made with your Chime Credit Builder Visa® Credit Card up to your SpotMe limit if you're eligible and have the. Chime, the popular online mobile banking platform, launched a secured credit card aimed at helping users build credit. Here's what you should know and how. How it Works. Chime will report your payment history to the major credit bureaus. As you start chaining together on-time payments every month, your credit. Additionally, while the Chime Credit Builder card reports to all three major credit bureaus, it's not the only factor that impacts your credit score. Payment. I transfer money into my account, then over to my credit builder card. Then I pay my bills to help credit. My score went up around 14 points so far in a month. While Chime provides some features that can be helpful for managing your finances, it's important to note that it does not directly report your. How does Chime Credit Builder work? Users need to move money into their Credit Builder secured account through the Chime app. This determines. Not only would a credit product help Chime members build credit, but it would also help them fit into traditional credit modeling with a product.

How Much To See A Financial Advisor

A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. A minimum annual fee applies. Financial firms charge clients in many different ways. At One Day In July you pay us one asset-based advisory fee. See a list. For example, if an advisor charges a $2, retainer fee at $ an hour, you'll have 10 hours of planning services available to use throughout the year. Each. A financial advisor should do far more than just pick investments. An advisor can help you prioritize your financial goals, develop a plan to reach them and. look for and where to look for a financial adviser can feel overwhelming. There are many other types of advisers out there, though — some work for. There is no set price for hiring a financial advisor; the cost for financial advice and strategy is dependent on numerous factors, including the tasks requested. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. A fee-only advisor charges no commissions as part of their advisory or wealth management services. They are not compensated in any way by an outside company. How much does Business Financial Planning cost? · Average Price $90 - $ per hour · Get quotes from Financial Planners near you · Find a Financial Planner near. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. A minimum annual fee applies. Financial firms charge clients in many different ways. At One Day In July you pay us one asset-based advisory fee. See a list. For example, if an advisor charges a $2, retainer fee at $ an hour, you'll have 10 hours of planning services available to use throughout the year. Each. A financial advisor should do far more than just pick investments. An advisor can help you prioritize your financial goals, develop a plan to reach them and. look for and where to look for a financial adviser can feel overwhelming. There are many other types of advisers out there, though — some work for. There is no set price for hiring a financial advisor; the cost for financial advice and strategy is dependent on numerous factors, including the tasks requested. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. A fee-only advisor charges no commissions as part of their advisory or wealth management services. They are not compensated in any way by an outside company. How much does Business Financial Planning cost? · Average Price $90 - $ per hour · Get quotes from Financial Planners near you · Find a Financial Planner near.

To connect with an advisor and learn more, call or get a free consultation. How you'll pay for our services. Once you find a financial advisor. Here are some of the many occasions when it could be helpful to work with a financial advisor: Other ways to get affordable financial advice. Try out. Many near military installations. Complimentary financial planning. For active It's never too early to get a financial advisor. Here are 6 must-ask. Charges can vary depending on the type of advice you are getting. Financial advisers generally get paid by: Commission – Where a financial adviser receives. A financial advisor who charges a percentage based on the assets they manage may be another option. This fee can range from % to 2%. Advisors that charge a. Financial advisors often charge an Assets Under Management (AUM) fee - usually 1%. That means you pay your advisor a percentage of your accounts. As your money. You can usually work with these advisors no matter how much money you have. When should I get a financial advisor? Many people find it helpful to meet with a. There are several factors that go into determining how much it will cost to work with a financial advisor at Ameriprise. Consumers should consult with their. If your adviser charges a portfolio percentage, ask what this fee is in dollars. The percentage may seem much lower than the dollar amount. Commissions. A. The Cost of Financial Advisor Fees When it comes to the cost of a financial planner, most firms charge fees based on a percentage of assets under management . – Flat fee of $2, to $4, for a one-time service. The costs vary greatly, as you can see. Why do the costs vary significantly? You will see fees vary depending on the clientele served. $ monthly retainer for gen Y, a $6, minimum retainer for a comprehensive planner. In fact, investors who get professional financial advice are more likely to feel confidence about achieving their goals Percentage of investors who say. For example, if an advisor charges a $2, retainer fee at $ an hour, you'll have 10 hours of planning services available to use throughout the year. Each. If your adviser charges a portfolio percentage, ask what this fee is in dollars. The percentage may seem much lower than the dollar amount. Commissions. A. More and more smaller investors are choosing a financial advisor that charges a flat fee instead of an AUM fee. They may charged a stated fee for a financial. Additionally, our data shows that the the median startup costs for a financial advisor are around $K. Remember, though, not all financial advisors are the. Key takeaways · Learn the meaning of fiduciary · Know the difference between fee-only and fee-based · Use your network and online resources · Consider the. Learn more about how fee-only planners and fiduciary advisors work in a client's best interest. Visit the NAPFA site today for more information. Transaction Fee. Reduced Transaction Fee* ; Electronic Trades. $ $24 ; Broker-Assisted Trades. $ $45 ; Automatic Investment Plan (AIP) Trades:** N/A. $

Is There Crypto On Td Ameritrade

US broker TD Ameritrade has confirmed it is rolling out a more comprehensive cryptocurrency trading portfolio in what mainstream media describes as the firm. There are a number of strategies you can use for trading cryptocurrency in Cryptopolis reported that TD Ameritrade customer service seemed unaware of the symbol. While TD Ameritrade doesn't offer direct cryptocurrency trading like dedicated crypto exchanges, it provides access to Bitcoin and Ethereum. TD Ameritrade's primary specialty is stock trading however you can also trade other products such as ETFs, mutual funds, forex, bonds, options, futures, and. Watch the latest updates on crypto news, bitcoin news as well as insight TD Ameritrade Network is now Schwab Network. Learn more · subscribe · ways to. Latest news and analysis on TD Ameritrade (85 items) ; · Robo-advisers are facing their first major downturn ; · Charles Schwab to acquire. TD Ameritrade Invests in Crypto Exchange ErisX ErisXs plan is to offer traders access to cryptocurrency spot contracts as well as futures contracts on a. You can buy and sell Crypto ETFs with a TD Direct Investing account, find out more here. the price of Ether, which is a cryptocurrency based on Ethereum. Clients looking for spot bitcoin ETFs or spot ether ETFs can find these and other third-party ETF and mutual fund products available at Schwab. These funds. US broker TD Ameritrade has confirmed it is rolling out a more comprehensive cryptocurrency trading portfolio in what mainstream media describes as the firm. There are a number of strategies you can use for trading cryptocurrency in Cryptopolis reported that TD Ameritrade customer service seemed unaware of the symbol. While TD Ameritrade doesn't offer direct cryptocurrency trading like dedicated crypto exchanges, it provides access to Bitcoin and Ethereum. TD Ameritrade's primary specialty is stock trading however you can also trade other products such as ETFs, mutual funds, forex, bonds, options, futures, and. Watch the latest updates on crypto news, bitcoin news as well as insight TD Ameritrade Network is now Schwab Network. Learn more · subscribe · ways to. Latest news and analysis on TD Ameritrade (85 items) ; · Robo-advisers are facing their first major downturn ; · Charles Schwab to acquire. TD Ameritrade Invests in Crypto Exchange ErisX ErisXs plan is to offer traders access to cryptocurrency spot contracts as well as futures contracts on a. You can buy and sell Crypto ETFs with a TD Direct Investing account, find out more here. the price of Ether, which is a cryptocurrency based on Ethereum. Clients looking for spot bitcoin ETFs or spot ether ETFs can find these and other third-party ETF and mutual fund products available at Schwab. These funds.

Our TD Ameritrade integration lets you deploy live trading algorithms on our co-located servers that trade the capital you have in your TD Ameritrade. Introducing Schwab Trading Powered by Ameritrade™—a trading experience you can't get anywhere else, featuring the award-winning thinkorswim platforms, tailored. TD Ameritrade is very good, and their Thinkorswim platform is one of the best in the business. I have been using them for many years as my. The average TD Ameritrade account balance for investors in the crypto market varies depending on individual preferences and investment strategies. Some. What accounts can I hold Crypto ETFs within? Like other traditional ETFs, Crypto ETFs can be bought and sold in all accounts available at TD Direct Investing. Elevate your trading journey with TD Ameritrade, a distinguished global leader in forex and CFD platforms headquartered in Omaha, Nebraska, United States Also. TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim trading platforms and. These ETFs can be bought and sold for FREE within TD Ameritrade accounts. Compare their year-to-date performance, price, total assets and ratings. Cryptocurrency3. tastytrade. TD Ameritrade. -. Schwab. -. E*TRADE. -. Fidelity The value of any cryptocurrency, including digital assets pegged to fiat. In the wake of TD Ameritrade quietly opening Bitcoin trading for some of its customers, I was just told that eTrade is preparing to begin. In a definite first, TD Ameritrade and Havas have placed an ad in the blockchain as a celebration of innovation and creativity. The digital asset platform will support both Bitcoin and Ethereum trading. Fidelity created a separate company for the launch, Fidelity Digital Asset Services. TD Ameritrade offers all the usual suspects you'd expect from a large brokerage firm. While Fidelity supports trading across multiple assets, futures, options. Introducing Schwab Trading Powered by Ameritrade™ — a trading experience you can't get anywhere else, featuring the award-winning thinkorswim® platforms. The digital asset platform will support both Bitcoin and Ethereum trading. Fidelity created a separate company for the launch, Fidelity Digital Asset Services. The steps to conduct trade in Bitcoin futures are the same as those for a regular futures contract. You begin by setting up an account with the brokerage or. If your account is futures approved, you can request access to trade Bitcoin futures and Micro Bitcoin futures through the CME exchange. TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets. The company was founded in as First. TD Ameritrade's primary specialty is stock trading however you can also trade other products such as ETFs, mutual funds, forex, bonds, options, futures, and.

How A Margin Call Works

How margin calls work. Margin, aka leverage, could be likened to a mechanic's wrench—a tool investors and traders use with the aim of boosting their buying. A margin call is a request by a broker for an investor to deposit funds into their investment account to keep all their positions open. If the margin call. If your equity falls below the minimum because of market fluctuations, your brokerage firm will issue a margin call (also known as a maintenance call), and you. Margin call is when the equity on your account drops below your margin requirement Please ensure you understand how this product works and whether you can. Regulations require that you maintain a minimum of 25% equity in your margin account at all times. However, most brokerage firms maintain margin requirements. Margin calls happen when the percentage of the equity in the account drops below the maintenance margin requirement. At XTB, a margin call occurs when your. When the value of a margin account falls below the broker's required amount, the investor must deposit further cash or securities to satisfy the loan terms. Brokers deduct daily MTM loss from maintenance margin. This amount is typically lower than the initial margin requirement. Margin Call: This is a call or notice. A margin call is a demand from your brokerage firm to increase the amount of equity in your account to meet margin requirements. Learn more. How margin calls work. Margin, aka leverage, could be likened to a mechanic's wrench—a tool investors and traders use with the aim of boosting their buying. A margin call is a request by a broker for an investor to deposit funds into their investment account to keep all their positions open. If the margin call. If your equity falls below the minimum because of market fluctuations, your brokerage firm will issue a margin call (also known as a maintenance call), and you. Margin call is when the equity on your account drops below your margin requirement Please ensure you understand how this product works and whether you can. Regulations require that you maintain a minimum of 25% equity in your margin account at all times. However, most brokerage firms maintain margin requirements. Margin calls happen when the percentage of the equity in the account drops below the maintenance margin requirement. At XTB, a margin call occurs when your. When the value of a margin account falls below the broker's required amount, the investor must deposit further cash or securities to satisfy the loan terms. Brokers deduct daily MTM loss from maintenance margin. This amount is typically lower than the initial margin requirement. Margin Call: This is a call or notice. A margin call is a demand from your brokerage firm to increase the amount of equity in your account to meet margin requirements. Learn more.

A margin maintenance call is when your portfolio value (minus any crypto positions) falls below your margin maintenance requirement. Learn about the dangers of margin calls, which occur when the value of an investment sinks below the required collateral in a brokerage account. Margin calls are a mechanism that brokers use to protect themselves and their clients from losses. A margin call occurs when an investor's account falls below. A margin call is not good news. It happens when the amount of equity you hold in your margin account becomes too low to support your trades and other. You'll get this call when your equity falls below Vanguard Brokerage's house maintenance requirement, which is 35% for most marginable securities. Since you've. A margin call is triggered when the combined value of cash and/or securities (used as a collateral for your loan) drops below the minimum amount you require to. What is a margin call? The broker makes margin calls when equities in the MTF account falls below the maintenance margin. The MTF account contains securities. A margin call works by alerting you that your positions are now at risk of being closed on your behalf. At sculptura-spb.ru, we'll start closing positions if your. A margin call is an alarming term for an investor. It is a demand from a broker to deposit additional funds or securities to meet the minimum maintenance. $3,/($3, + $8,) = 30% → reached margin requirement. By selling stocks, you decrease the amount of margin, therefore increase the percentage of the. When you get a margin call, it often indicates that the price of the securities in your margin account has fallen. When an investor receives a margin call, they. How margin calls work. The brokerage issues a margin call in the stock market when an investor's account equity falls below a certain level. If the investor. A margin call is the term for when a broker requests an increase maintenance margin from a trader, in order to keep a leveraged trade open. A margin call is when it goes down so much that you lost all your money and the bank takes what's left. So if you started with $, and. In the context of energy commodities trading, as with other forms of trading, a margin call is a request from a broker to an investor to deposit additional. How Does a Margin Call Work? One of the most important things to understand about margin calls is that your open positions can be sold by the lender without. Being “margin called” means the lender/broker has decided to demand immediate payment. As such they force an immediate exit from all of your. How does a margin call work? Given that financial markets can be volatile and move rapidly, it is imperative that traders are notified when their equity is. Margin call is when the equity on your account—the total capital you have deposited plus or minus any profits or losses—drops below your margin requirement. You.

Is A Cd A Money Market Account

CDs are like savings or money market accounts in that they allow you to put money away for a set period. That way you can save toward a specific goal like a. Savings & Money Market Account Options · Business Savings · Certificate of Deposit (CD) Account · Central Business Money Market Account. CDs and money market accounts are both safe ways to earn more interest on your cash. With a CD, you can get a higher interest rate if you can leave the money. Learn more about Huntington's personal Savings accounts, Money Market Accounts, or CDs. Choose from one of our savings accounts and open online today. At BankSouth, you can easily access your hard-earned savings through Online, Mobile, or Telephone Banking to quickly transfer funds between accounts. Money Market Accounts offer the opportunity to earn higher interest than a regular savings account and give you the convenience of access by check. Key takeaways · Both money market funds and CDs are considered relatively safe investments, potentially providing returns in the form of interest or dividends. Another way these accounts differ is that the savings rates on MMAs is variable, meaning it can go up or down depending on the market, which is beneficial if. There are several differences between a Certificate of Deposit (CD) and a money market account. But, the key is really about your intentions. CDs are like savings or money market accounts in that they allow you to put money away for a set period. That way you can save toward a specific goal like a. Savings & Money Market Account Options · Business Savings · Certificate of Deposit (CD) Account · Central Business Money Market Account. CDs and money market accounts are both safe ways to earn more interest on your cash. With a CD, you can get a higher interest rate if you can leave the money. Learn more about Huntington's personal Savings accounts, Money Market Accounts, or CDs. Choose from one of our savings accounts and open online today. At BankSouth, you can easily access your hard-earned savings through Online, Mobile, or Telephone Banking to quickly transfer funds between accounts. Money Market Accounts offer the opportunity to earn higher interest than a regular savings account and give you the convenience of access by check. Key takeaways · Both money market funds and CDs are considered relatively safe investments, potentially providing returns in the form of interest or dividends. Another way these accounts differ is that the savings rates on MMAs is variable, meaning it can go up or down depending on the market, which is beneficial if. There are several differences between a Certificate of Deposit (CD) and a money market account. But, the key is really about your intentions.

Savings & Money Market Account Options · Business Savings · Certificate of Deposit (CD) Account · Central Business Money Market Account. Banking products provided by Wintrust Financial Corp. banks. ©Wintrust All Rights Reserved | Sitemap. FDIC. We will compare money market accounts to CDs and savings accounts, explain the different cash alternative options, and the steps to choosing the right cash. While searching for what a money market savings account is, you may have come across another type of savings account called a certificate of deposit, or a CD. Both accounts earn interest. But CDs limit access to your money during the term and money market accounts don't. Relationship Plus Money Market · $10 monthly maintenance fee, waived with a $5, minimum daily balance · You may get higher interest rates when you also have. Though money market accounts usually have lower interest rates than CDs, they enable owners to access funds as needed. They generally require larger minimum. Shopping around for a savings product and want to know the difference between a money market account and a certificate of deposit? Learn more about the. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Learn about CDs and money market accounts – both interest-bearing accounts – and see which may work best to take advantage of higher APYs (annual percentage. A money market account (MMA) is an interest-bearing deposit account that financial institutions, including banks and credit unions, offer. While searching for what a money market savings account is, you may have come across another type of savings account called a certificate of deposit, or a CD. Three popular places to save money are in a CD account, money market account and a high-yield savings account. Each account comes with a few key differences. Enjoy a higher rate than a checking account while maintaining access to your funds when you need them. Open your account in branch or online. Money market accounts These accounts provide many of the benefits and features of both savings and checking accounts. They generally pay higher interest rates. Let's compare 4 dollar bills as they make their way through 4 different types of accounts: a checking account, a savings account, a money market account and a. Rates effective 08/27/ As of Feb. 9, , the Edward Jones Money Market Fund (Fund) is no longer available for new Select accounts or existing Select. A money market account (MMA), also known as a money market deposit account (MMDA), is a type of interest-earning savings account offered by some banks and. Relationship Plus Money Market · $10 monthly maintenance fee, waived with a $5, minimum daily balance · You may get higher interest rates when you also have. Two financial products that can help you earn a higher interest rate on your money are CDs (also known as a certificate of deposit) and money market accounts.

Bankrate For Refinance

Compare current year refinance rates ; Star One Credit Union. 10 year fixed refinance. Points: 0. %. 10 year fixed refinance. % ; Schools First FCU. Northpointe Bank Rate Refresh offers reduced closing costs if you decide to refinance the loan used to purchase your primary home now. Offer is limited to. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. If you're considering refinancing, check our current mortgage refinance rates. They're our lowest available, with a% interest rate discount when you Bank. Index performance for sculptura-spb.ru US Home Mortgage 30 Year Fixed Refinance Rate National Avg (ILMCNAVG) including value, chart, profile & other market. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. Compare year refinance rates and find your preferred lender. Check rates today to learn more about the latest year refi rates. Compare current year refinance rates ; Star One Credit Union. 10 year fixed refinance. Points: 0. %. 10 year fixed refinance. % ; Schools First FCU. Northpointe Bank Rate Refresh offers reduced closing costs if you decide to refinance the loan used to purchase your primary home now. Offer is limited to. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. If you're considering refinancing, check our current mortgage refinance rates. They're our lowest available, with a% interest rate discount when you Bank. Index performance for sculptura-spb.ru US Home Mortgage 30 Year Fixed Refinance Rate National Avg (ILMCNAVG) including value, chart, profile & other market. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. Compare year refinance rates and find your preferred lender. Check rates today to learn more about the latest year refi rates.

Save Money—If a borrower negotiated a loan during a period of high interest rates, and interest rates have since decreased, it may be possible to refinance to a. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. % % APR. Closing costs vary by location and average between 2 percent and 5 percent, according to Bankrate. “You need to consider how long it will take to recoup the. Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. Thinking of refinancing? Use these tools and advice to determine if a mortgage refinance is right for you. As of Saturday, August 24, , current interest rates in New York are % for a year fixed mortgage and % for a year fixed mortgage. Shop around. Visit Allied Mortgage Group, Inc. site. NMLS # | State Lic: () 30 year fixed refinance. Points: 8 year cost: $, %. The cost of refinancing typically comes out to about 2% to 3% of the total loan amount, according to U.S. News. It can take years to recoup the costs and buying. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Weekly national mortgage interest rate trends ; 20 year fixed refinance, % ; 10 year fixed refinance, % ; 30 year fixed refinance, %. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Are you thinking of refinancing your home mortgage? Chase offers competitive mortgage refinance rates. See which of the current refinance rates work for. Today. The average APR for the benchmark year fixed mortgage rose to %. Last week. %. year. Refinancing at a shorter repayment term may increase your mortgage payment, but may lower the total interest paid over the life of the loan. Contact us to. Weekly national mortgage interest rate trends ; 5/1 ARM refinance, % ; 30 year fixed refinance, %. Bankrate isn't a mortgage lender. Rather, it's a personal finance website providing resources and tools to compare lenders in your area. For the past four. Cash-out refinance rates · Credit score: A higher credit score can help you qualify for a lower mortgage rate. · Loan-to-value ratio (LTV): A lower LTV ratio can. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing.